- TRADING PLATFORM REVIEWS

- TRADING PLATFORM UK

- BLOG

- CONTACT US

A fund trading platform is an application that allows you to trade on the world's financial markets. It provides a place where you can place trades and manage your account, all with just one login. A trading platform offers several advantages over other types of trading platforms, including:

A fund trading platform is an application that allows you to trade on the world's financial markets. It provides a place where you can place trades and manage your account, all with just one login. A trading platform offers several advantages over other types of trading platforms, including:

A good fund trading platform is available 24/7 and provides support in your local time zone, in your language, and from a human being. It also offers a variety of communication channels (such as email, live chat, or phone) so that you can choose the one that works best for you.

For example: if you prefer to be able to contact someone directly via email or live chat during the day but would rather wait until later on in the evening when everybody else has gone home before picking up your phone and calling them up, this is possible with some platforms. That way, no matter what time of day it is for you, there will always be someone available to help!

In our experience, costs are the biggest factor in fund performance. You can think of it like this: if you were trying to build a house, but you didn't have enough money to buy all the materials, it's not going to be very impressive when you're finished. It might be tall and wide, but it won't have any windows or doors! The same is true with investment funds: even if they follow an excellent strategy that offers consistent returns over time (like buying shares in companies that are growing quickly), they will perform poorly if they don't have enough cash on hand to do so.

If your goal is long-term growth—and who isn't?—then low costs should be at the top of your list of priorities when choosing an investment fund. Why? Because higher costs lead to lower returns for investors, meaning that your hard-earned money will earn less over time than it otherwise would have been able to grow without being eaten up by fees and other expenses paid by funds' managers and distributors (aka salespeople).

High-speed trading is a key advantage of fund trading, and it's possible because of the speed of the internet. The ability to trade quickly and efficiently is what makes high-speed trading a powerful tool that can help investors make more money.

For example, if you think a certain stock is going to rise in value, you can buy shares in that company before everyone else does so that when the price rises after market hours, your position will be worth more than if you had waited until morning. This type of strategy allows investors to get ahead of their competitors and make better investments with less risk involved.

A tight spread is a sign of a good trading platform. A tight spread is the difference between the bid and asks prices for a particular financial instrument, which indicates how liquid an asset is.

The smaller the price differential, the more liquidity you get from your broker or exchange. This means that you can get in and out of positions faster and make more profit per trade because there's less friction between buying and selling assets at higher volumes than what would otherwise be possible if trading on a wider spread.

If you plan on doing any sort of volume-based trading (which we recommend), having a tight spread is vital to your success as an investor.

Narrow markets are better for traders.

Why? Well, the more activity there is in a market, the harder it is to predict where the price will go next. In a narrow market, however, there aren't as many traders (or they're trading with less money), so their actions have a smaller impact on prices and make it much easier to predict what's going to happen next.

Futures and options markets are available. Futures markets are used to hedge risk, while options markets are used to increase returns. Both futures and options can be used to increase diversification, reduce risk, or a combination of both.

Market-making collateral management is a service provided by a broker to help hedge funds, other market participants, and investors manage the risks associated with their trading activities. It is also known as collateral optimization or collateral origination.

The service helps hedge funds reduce their funding costs by providing access to cheaper capital compared to what they could get through bank loans or other traditional financing methods such as asset-backed commercial paper (ABCP).

It allows traders at hedge funds to take advantage of flexible capital structures in order to make more profitable trades without increasing their risk exposure.

Market makers can use this service to increase their liquidity and enhance customer loyalty by giving them direct access to securities that would otherwise be unavailable on retail platforms.

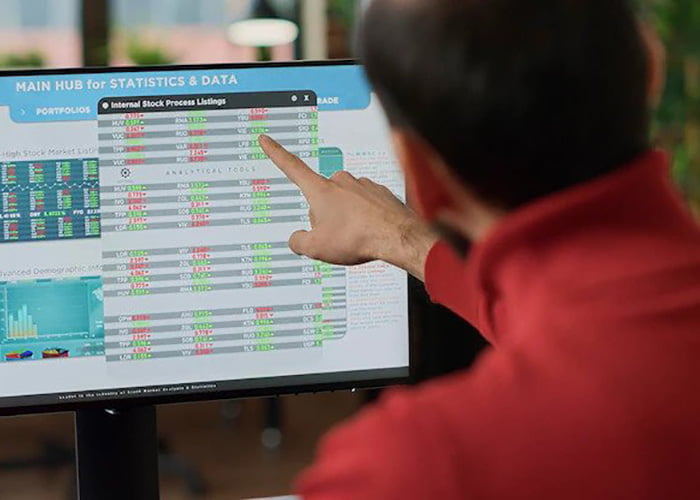

One of the most important benefits of fund trading platforms is the comprehensive performance monitoring tools that are provided by these solutions. These performance tracking tools can be used to make better decisions, identify problems and opportunities, identify risks, improve your investment performance, and more.

The best fund trading platforms will offer several types of monitoring tools that you can use to better understand how your investments are performing over time.

It's important to have access to the right information, and it's even more important that you understand what it means. There are many tools available on trading platforms that provide information about your funds, including:

The fund trading platform is a great way to trade, whether you're just starting out or you're already established. You can trade on your own or with a group and in a variety of markets, currencies, and commodities—stocks are also included in this category!

Let's say that you're working at a company that specialises in trading hedge funds. You could use the fund trading platform to generate revenue for your business by allowing clients to buy and sell stocks from their accounts directly through the system. In this way, they don't have to go through an intermediary; instead, they can buy and sell shares directly from their computers using the software provided by your company.

We hope that we have convinced you to give fund trading a try. We know it can be overwhelming, but we are here to help. Our support staff is always on hand with expert advice and guidance, so please don't hesitate to reach out if you have any questions or concerns!

If you're looking for information, news, reviews and data about the available trading platforms in the UK, Trading Platforms UK is the site for you. We provide all of this and more, so be sure to visit us today!

2022 © Copyright Trading Platforms UK